After watching...

Schedule Your Time With Us

Jump on a quick 30 minute call to see if you are a good fit for NEXA Mortgage & if we are a good fit for you.

Why NEXA? Call Highlights

Part 1: Nexa Mortgage: Unveiling Transparency and Opportunities

Introduction to NEXA Mortgage and Mike Kortas

Welcome to the introduction of NEXA Mortgage, led by Mike Kortas, the CEO and founder. In this session, Mike extends a warm welcome and expresses gratitude to the participants. This introduction sets the stage for a transparent and open dialogue, emphasizing the importance of clear communication within the organization.

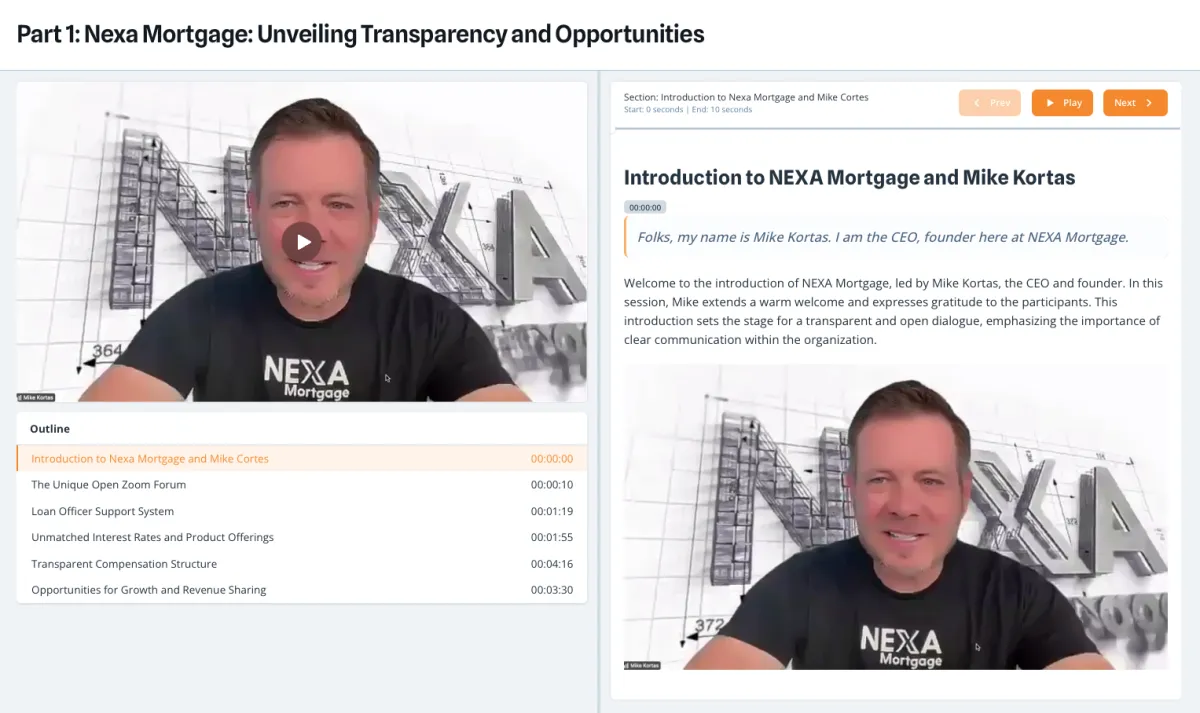

Part 2: Understanding NEXA Mortgage's Compensation and Growth Strategy

NEXA Mortgage offers a comprehensive compensation plan designed to maximize earnings for both individual brokers and teams. A key feature of this plan is the correspondent transaction model, where participants receive one hundred percent of the entire transaction within a calendar month. This model is particularly advantageous for those who manage or are part of a team, as it allows for cumulative volume calculations. By consolidating all team or branch transactions under one name, any volume exceeding two million dollars is recognized collectively, enhancing potential earnings.

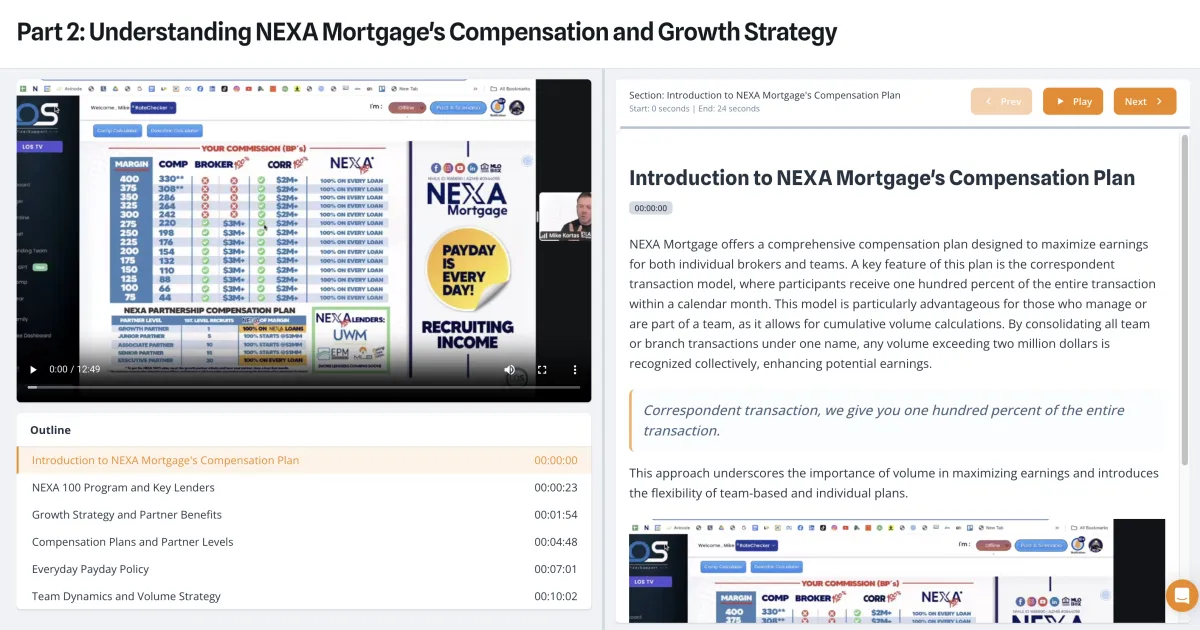

Part 3: Understanding NEXA Mortgage's Unique Business Model

NEXA Mortgage stands out in the mortgage industry with its unique approach to commission and fees. The company emphasizes transparency in its financial dealings, ensuring that loan officers and clients alike have a clear understanding of the compensation structure. A key aspect of NEXA Mortgage's model is its commitment to paying a hundred percent commission in various formats, as highlighted in the discussion about sharing purchase advice to provide proof of this commitment.

Part 4: Navigating Success with NEXA Mortgage: Opportunities and Strategies

Welcome to the introduction of NEXA Mortgage Opportunities. In this section, we will explore the unique offerings and opportunities available for loan officers at NEXA. Understanding the NEXA system is crucial for success, and this overview will set the stage for what you can expect.

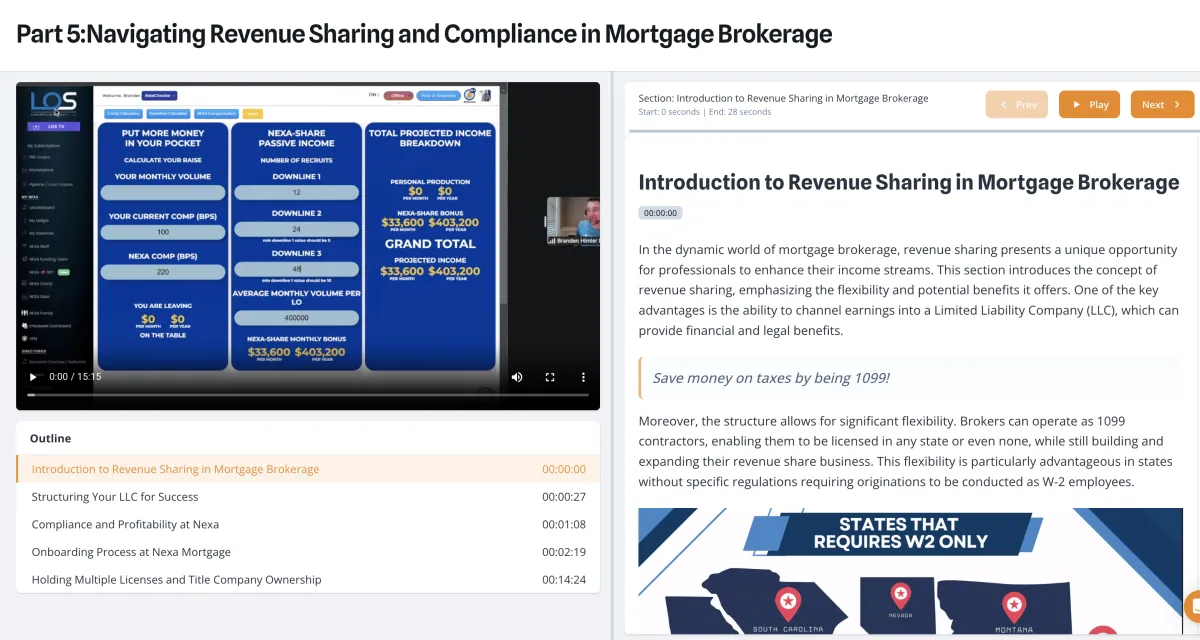

Part 5: Navigating Revenue Sharing and Compliance in Mortgage Brokerage

In the dynamic world of mortgage brokerage, revenue sharing presents a unique opportunity for professionals to enhance their income streams. This section introduces the concept of revenue sharing, emphasizing the flexibility and potential benefits it offers. One of the key advantages is the ability to channel earnings into a Limited Liability Company (LLC), which can provide financial and legal benefits.